How to Choose Payroll Software: Key Factors and Tips

Payroll software can dramatically simplify how you run your business. It streamlines processes, saves you valuable time, and ensures your employees get paid — but only as long as you choose the right payroll service for your organization’s unique needs.

There are dozens if not hundreds of payroll software tools made for businesses like yours, so it makes sense if you’re not sure how to start narrowing down your options. Keep reading to learn more about what to look for in payroll software, which features to prioritize, and more.

What to look for in a payroll software

View our payroll software evaluation checklist for use in your payroll software evaluation process. Using this list, you can check off the features that are important for you, then be sure to ask for those features during demos with the company. You can also look for them when comparing providers and testing software using free trials.

1. Is it easy to use?

When I evaluate a payroll software for its ease of use, my first step is to see if the software provider offers a free trial or a free account I can use to test the product myself. If I cannot test the product myself by signing up for an account on the provider’s website, I either reach out to the company to ask for a free trial, or I ask for a product demo.

As I explore the product, I specifically pay attention to:

- How easy it is to set up the software and add employees.

- How easy it is to find features that I will most use.

- If there are strategically placed links or buttons that make it clear what my options are within each feature and next steps for completing common tasks.

- Once I click on a button to begin a process within the software, if the software guides me on how to complete or set up the process.

- If completing common tasks requires technical knowledge or if tasks can be completed by filling out simple forms.

- How easy it is to set up integrations with key software I plan to use in conjunction with the payroll software, such as my time-tracking or accounting software.

- If there are a lot of extra features I will never use that overwhelm me.

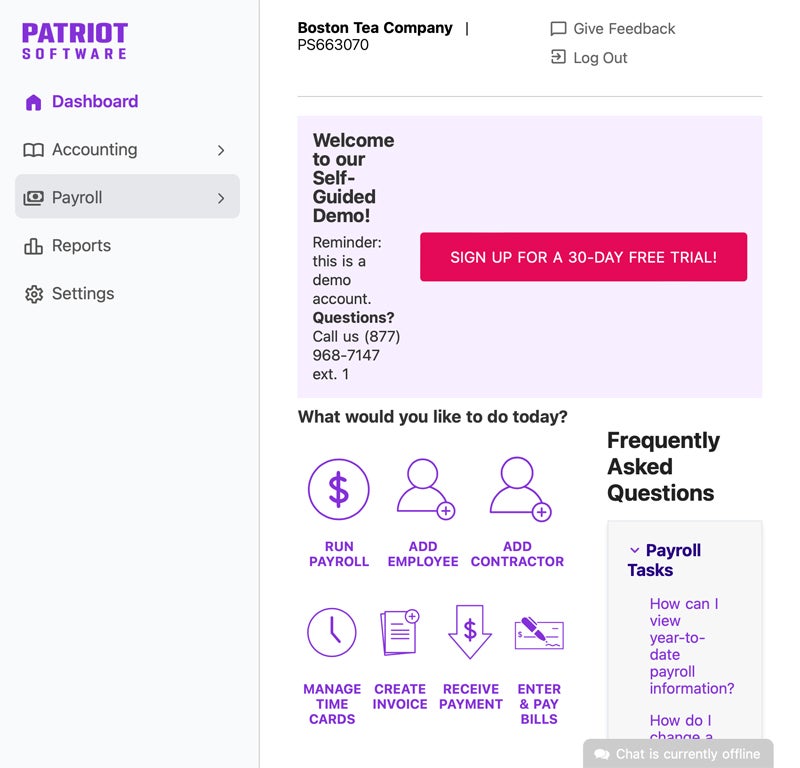

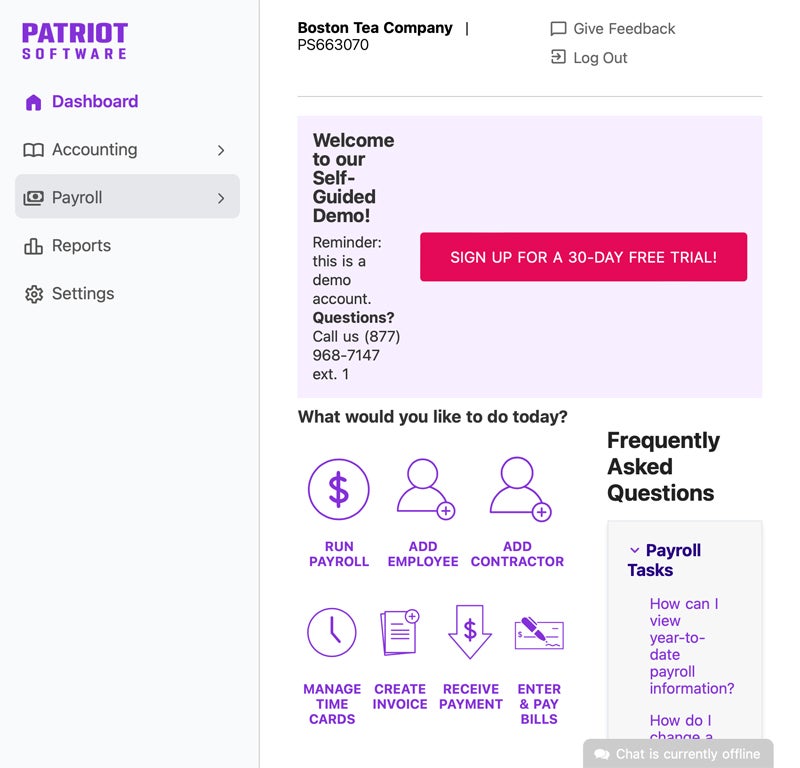

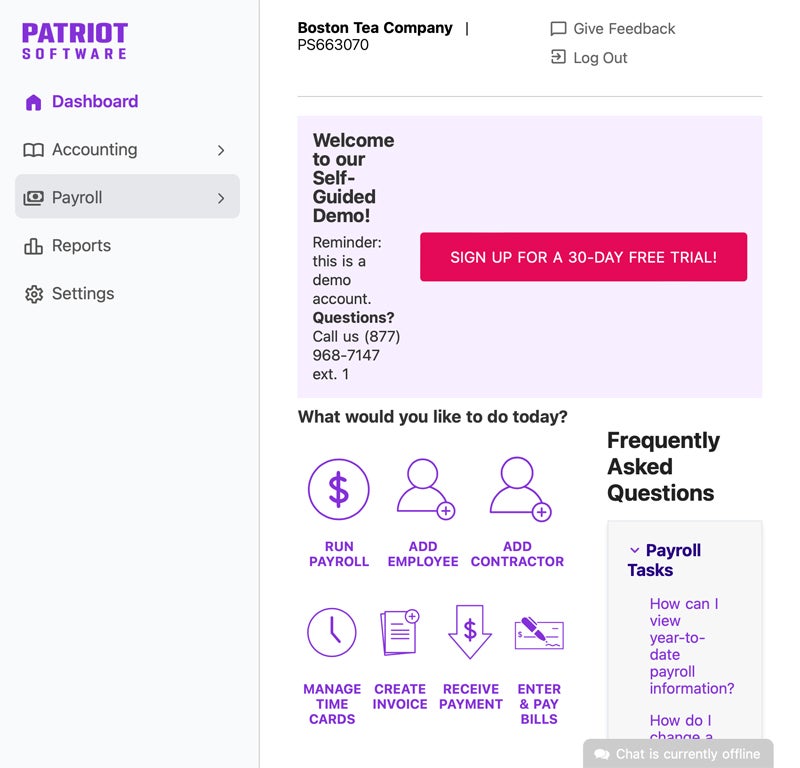

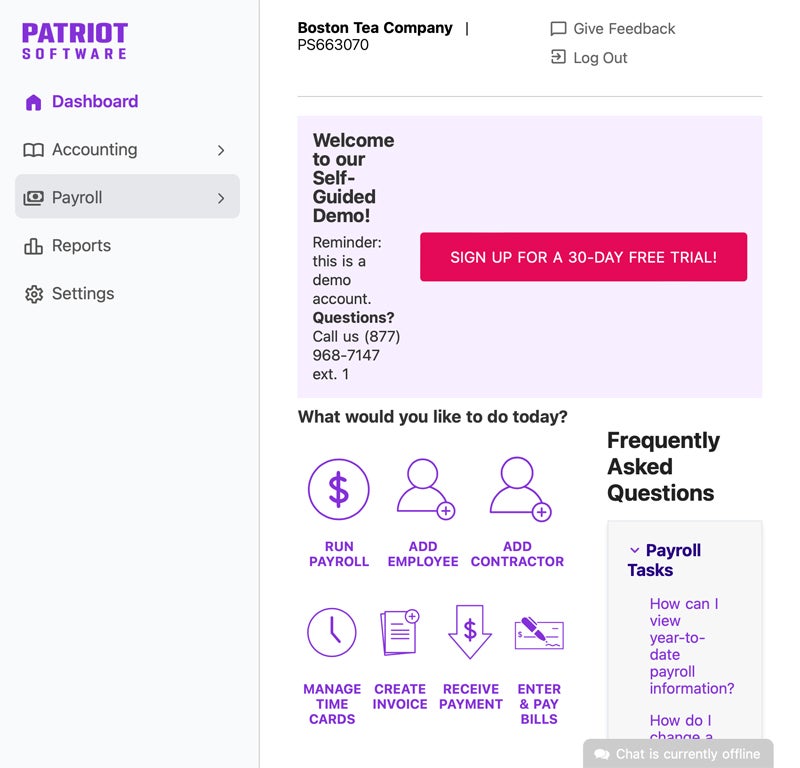

For example, Patriot offers a guided and intuitive user experience. Buttons are strategically placed throughout the platform with action items relevant to the content on each page. For example, the platform’s payroll dashboard offers buttons such as “create invoice,” “add employee,” and “run payroll.”

Once you click on a button, each action item walks you through completing the process using simple forms to fill out. These steps are completed in brief forms. Once you’re done with a step, you can click “next” to move on to the next one.

2. What types of workers can you pay?

While most payroll software allow users to pay employees, many also allow users to pay contractors. In addition, most allow you to pay U.S.-based employees, but a handful also allow you to pay foreign employees and contractors. As such, take an inventory of the types of workers you currently employ and your plans for working with other types of workers in the future.

If you find that you want to work with foreign employees or contractors, in addition to ensuring you can pay both 1099 and W-2 employees, check to see if the software you choose offers employer of record (EOR) and contractor of record (COR) services that will allow you to hire and pay employees in foreign countries without having to set up business entities within the country. In addition, check to see what currencies you can use to pay employees and the countries it supports.

If you plan to hire contractors, make sure safeguards are in place to ensure compliance with classification laws and protection against misclassification penalties; these types of safeguards can help you determine whether a worker can be classified as a contractor. Deel, for example, offers COR services that allow you to pass on misclassification liabilities to Deel while leaning on Deel experts to advise you on the correct classification for each new hire.

3. How are labor taxes handled?

When I evaluate a payroll software, I pay close attention to how it supports client businesses in managing their labor tax obligations. Since many small businesses don’t have on-staff tax experts, I believe the best payroll software should offer the following supports:

- Automatic labor tax calculations and deductions.

- Automated tax payment remittance to local, federal, state, and global if applicable authorities.

- Multi-state tax management support.

- Tax error detection alerts.

- Penalty protection that covers punitive charges should the software miscalculate or miss paying the correct amount of taxes.

- End-of-year tax filing tools, processes, and support.

- An employee self-serve portal where employees can access their tax documents automatically.

- Tax experts to guide you in any questions you may have regarding your labor taxes.

4. Does it offer automated payroll calculations?

At its most basic, payroll software exists to calculate employee paychecks automatically so you don’t have to. Most payroll software can accommodate salaried and hourly employees, but double-check that both are included in the payroll service you choose before signing up.

If you have hourly employees, make sure your payroll software either integrates with time and attendance software or offers a built-in time tracking solution; otherwise, you’ll have to enter employees’ hours worked by hand, which wastes time and increases the possibility of introduced errors.

Paycheck calculation is about more than calculating an employee’s gross pay, or the total compensation they’re entitled to based on their hours worked. Payroll software also calculates employees’ net pay, which accounts for paycheck deductions like the following:

- Wage garnishment, or court-ordered paycheck deductions for debts like spousal or child support.

- Income, Medicare, and Social Security taxes.

- Benefits deductions, such as employee-paid premiums for health insurance.

- Retirement contributions to 401(k) accounts or other retirement savings accounts.

The best payroll software should include payroll tax calculations with every plan, but wage garnishment is often an add-on feature that costs extra. (Services that include wage garnishment at no additional cost, such as OnPay, are relatively uncommon.) Some payroll software, like Patriot Payroll, lets you enter benefits deductions by hand but doesn’t include automatic benefits administration.

5. What payment options does it offer?

When looking at a software’s payment options, I look at its direct deposit options, its check options, whether it offers a pay card, what pay schedules it can accommodate, whether I can run unlimited pay runs each month, and if I can pay off-schedule payments such as bonuses. Here’s what to consider regarding each of these options:

- Direct deposit: Most payroll software offer one- or two-day direct deposit payroll options; some offer same-day direct deposit options. If you need a same-day direct deposit, check to see if any fees are associated with making this quick option available.

- Checks: Look to see if you can print out checks from the payroll software or if the provider delivers printed checks to your business. Keep in mind that some payroll software do not offer a pay-by-check option, so if you need this option, verify with your provider its availability.

- Pay schedules: Look to see if your chosen payroll software accommodates the pay schedule you’re used to, such as weekly, bi-weekly, or monthly. Also, consider whether you can pay off-cycle payments such as bonuses.

- Number of payroll runs: If you plan to pay employees more than once a month, be sure to ensure your chosen software accommodates more than one payroll run per month. Many offer unlimited payroll runs to remove this concern from your list.

- Pay card options: These are payment cards often provided by employers to employees who do not have a bank account and would like an alternative mode of receiving their payments via direct deposit.

6. Is it scalable?

A scalable payroll software allows you to continue using it efficiently even as you expand the number of users. To do so, it often includes the ability to tap into automations to increase efficiencies as needed and pricing plans that accommodate more users as needed. It might also include tools to allow you to outsource or hand over tasks to users, such as an EOR service and an employee self-serve portal. Other elements to consider are the number of users the platform allows and if you can increase your plan capacity and capabilities by purchasing higher tiered plans or add-ons.

For example, Rippling offers an employee grid (extensive employee profile) that captures key information about your employees, such as their roles, pay rates, locations, and more. Then, when a change is made, for example, to an employee’s role, all of their access options, pay rates, benefits, and even credentials are automatically changed to reflect and accommodate the needs of the new role. This means that even when you’re handling a large workforce, changes can be done instantly, allowing you to efficiently manage more.

7. What reporting and analytics does it offer?

By providing reporting and analytics functions, payroll software helps companies keep track of their obligations and ensure they can meet them. Some examples of key payroll reports to look for include:

- Payroll summary report: This report allows you to filter payroll information about an employee, department, or your entire workforce by a date range and often includes an accounting of gross and net wages, withholdings, and deductions.

- Payroll tax liability report: In this report, you’ll see what taxes were withheld from each employee’s wages and how much was remitted to government agencies as a result. You’ll also be able to see how much you still owe.

- Retirement contributions: This report offers the contribution amount to retirement plans such as 401(k) and 403(b) plans from both the employer and employee.

- Benefits reports: You can use this report to explore how many employees versus employers pay premiums.

Many software, such as ADP, offer the ability to create custom payroll reports that can often be created from scratch or from a template you change to accommodate your needs. For example, you can choose what data or fields you’d like to include, which employees it will cover, and filter options. For example, you may include only managers within a particular department, a field showing paid-time-off (PTO) accumulations and remaining balances, and a date range of only 30 days. Once you’ve created your custom report, you can often save it to continue tracking the specified data.

8. Does it offer compliance support?

Companies must carefully adhere to compliance laws pertaining to employee pay on the state and federal level; if they do not, they may be fined. Because the legalities involved in payroll compliance can be technical and complex, I look for a payroll software that automates and guides businesses to adhering to these regulations, even as they change. Some compliance tasks a good payroll software may help to manage include:

- Wage withholdings for child support and other garnishments.

- Adherence to the Fair Labor Standards Act (FLSA), the Equal Pay Act (EPA), the Federal Insurance Contributions Act (FICA), and federal income taxes (FIT), the Federal Unemployment Tax Act (FUTA) (including withholdings and remittance of associated payments).

- Adherence to regulations surrounding minimum wage and overtime pay requirements.

- Support for prevailing wages, often with state-specific legal guidance indicating the requirement to pay at minimum the average pay for similarly employed workers.

- Certified payroll requirements for federal contract jobs.

- Support for state-specific last paycheck and payday requirements.

9. Does it integrate with other software?

Many payroll software providers offer a means to directly integrate your payroll software with other technology you use to run your business’s accounting and HR functions. For example, many offer integrations with popular accounting, HRIS, and time-tracking software. This allows your payroll software to retrieve and sync employee data across all systems for more accurate payroll processing.

For example, if you integrate your time-tracking software with your payroll software, your payroll software gains instant access to the hours employees worked, allowing it to automatically calculate each employee’s pay each pay cycle. In doing so, you avoid manual input of hours worked and any errors that may arise from that human process.

So, take an inventory of the technology you’d like to integrate with your payroll software and check with your payroll software provider to ensure those integrations are possible, either via a direct integration partnership between the two platforms or an API that allows you to create a custom integration.

10. Can you customize the software?

Many payroll software offer methods you can use to customize the platform to your needs or brand. These customizations can be as simple as uploading your company’s logo to the software’s dashboard so clients and employees can experience a branded user interface. Or, customizations can be more complex.

For example, UKG Ready Payroll offers a customizable reporting functionality. You can create several dashboards with only the payroll reports you want on them, such as payroll equity reports. You can also save these dashboards to share with your team. From there, the platform will gather insights from your custom-built reports and offer AI-powered guidance on how your team should put them into action to improve your business.

A good way to evaluate whether a company offers the customizations your company needs is to book a demo with a sales representative and go over your specific customization needs. The representative can then walk you through whether those customization options are available and how easy or difficult it will be to implement them.

How to choose payroll software for your business

1. Consider your business’s workforce

Make a detailed list of your company’s payroll software needs. Consider the types of workers you hire, how many you have, where they work (in a particular state or out of the country), if they’re seasonal, your payment schedule, and how you plan to pay employees.

2. Understand which payroll features you need

Once you’ve thought carefully about your workforce’s needs, it’s time to dig into which payroll software features you can’t live without. You can find a more detailed description of the top payroll features in our comprehensive payroll guide.

3. Carefully calculate payroll costs

Nearly all of the best small-business payroll software systems charge both a monthly base fee and a per-employee fee. Consider both in your calculations. You’ll also want to consider add-on fees for services like accounting software integration, international payroll, employee benefits administration, multistate tax service, and time-clock software. Consider prioritizing software with multiple plans that you can easily scale up to as you hire more people.

4. Narrow down your payroll software options

Our article on the best payroll software of the year can serve as a jumping-off point for your research as you narrow down your options to the best payroll software to meet your needs.

If reading a longer review is overwhelming, here’s our greatest-hits list of payroll software to consider:

- Gusto ($40 per month plus $6 per person) is generally considered the top payroll software provider for small, midsize, and large businesses.

- Paychex ($39 per month plus $5 per person) has more add-on fees than most of its competitors, but it also has one of the best HR libraries of any combined HR and payroll product.

- OnPay ($40 per month plus $6 per person) is one of the most fully featured payroll companies with the fewest add-on fees and hidden costs.

- SurePayroll by Paychex ($20 per month plus $4 per person) is one of the cheapest payroll services made specifically for small-business owners.

- ADP (custom pricing only) offers a wide range of versatile payroll products that can accommodate the smallest of small businesses as well as massive global enterprises.

If you’re looking for the most affordable option, visit our best cheap payroll software and our best free payroll software guides.

5. Take advantage of demos and free trials

Many payroll software providers offer a free trial or free account setup; those that don’t will usually offer free, customized demos that walk you through every aspect of the software. Payroll software companies with free trials include the following:

While Gusto and Square Payroll don’t offer free trials, both options allow customers to set up accounts for free; you won’t be charged until you decide to run payroll for the first time.

6. Get expert advice from a payroll specialist or accountant

If you’re a new business owner processing payroll for the first time, I strongly recommend speaking with an accountant and payroll specialist to better understand your payroll responsibilities, including and especially your payroll tax obligations. An accountant can also point you toward the best payroll software for accountants, which could influence your final software decision.

7. Reevaluate as needed

If you’ve signed up for a payroll plan, started running payroll, and found that you love your new payroll software, that’s excellent news. Keep in mind, though, that it’s okay to switch providers if your payroll needs change or if your new software doesn’t help you as much as you hoped it would.